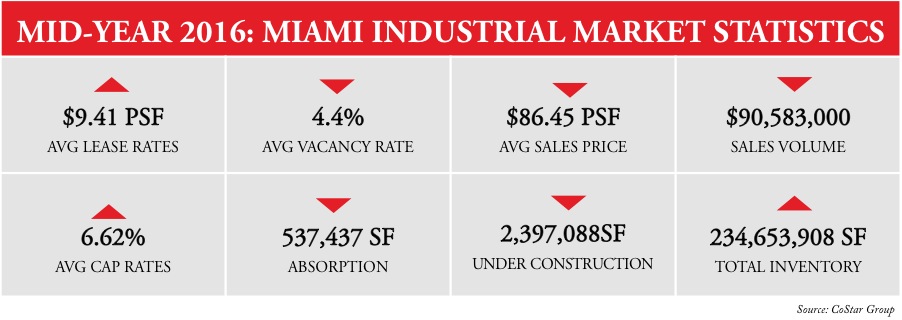

Midway through 2016 and the industrial market continues to grow. Once again average lease rates have increased slightly to $9.41 per sq. ft. and the vacancy rate has decreased slightly to only 4.4%. In our opinion, many of the available industrial properties are either overpriced and/or have functional challenges.

The largest lease transaction of the past quarter was Pricemart’s new 330,000 sq. ft. warehouse space at Flagler Station in Medley. COFE Properties’ acquisition of the 167,000 sq. ft. Webster Business Park for $16M was the largest sales transaction. In addition, we understand that South Florida Logistics Center’s six buildings are under contract to be sold this summer.

Several outside forces have been recently affecting the thought process of key decision makers in regards to industrial real estate in Miami. These issues include the opening of the new Panama Canal; the United Kingdom’s exit (BREXIT) from the European Union; the upcoming U.S. presidential election as well as a pending recession. Although we do not yet know the final effects, each are surely being taken into consideration. In the meantime, folks seem more immediately concerned with their summertime vacation schedules and avoiding any direct hits from hurricanes.

In case you missed our prior report, click this link for ComReal’s Miami Industrial Real Estate Report for the 1st Quarter of 2016. >>>

“Our team would like to hear from you. There is always room for improvement, and we would like to make this report better for you. Follow the link below to complete a short survey to help us serve you better. It should only take 2 minutes. Thank You!” Click here to TAKE SURVEY. >>>

Global logistics company, Seafrigo USA, expands to Miami warehouse just-in-time for new Panama Canal.

Ed Redlich, Stephane Desseigne, Mayor Gimenez and Chris Spear at PortMiami.

We are pleased to announce that Seafrigo, a global logistics company, is expanding their logistics services into the South Florida market, just-in-time for the new Panama Canal. Seafrigo is headquartered in France and specializes in the food logistics industry. The 30,000 sq. ft. warehouse space is located at 3200 NW 67th Avenue, in South Florida Logistics Center, in Miami.

“To our knowledge, Seafrigo becomes the first major company to locate to Miami partially due to the new Panama Canal expansion.” states Edward Redlich, SIOR, CCIM, Vice-President with ComReal. “This happens to be the fourth client that our team has represented in South Florida Logistics Center for a total of over 225,000 sq. ft. What is interesting is that all four tenant’s headquarters are based outside of the USA: France, Colombia and two from Canada. Three of the four clients are new to Miami. Miami is growing in a global marketplace!”

For the full story, please visit Seafrigo USA Warehouse in Miami. >>>

Miami Warehouses Leased in 2nd Quarter 2016 (partial list):

| Tenant Name | Size SF | Property Address |

| Pricesmart | 330,000 | 10800 NW 100 Street |

| Eco Window | 149,980 | 8502 NW 80 Street |

| Neutralogistics | 105,920 | 8502 NW 80 Street |

| GAP Forwarders | 31,759 | 11411 NW 107 Street |

| Seafrigo USA | 29,268 | 3200 NW 67 Avenue |

| Main Freight USA | 26,005 | 11411 NW 107 Street |

| Cortex USA | 25,230 | 8501 NW 17 Street |

| Suero Oral | 23,115 | 11411 NW 107 Street |

| Aerothrust | 21,000 | 1580 NW 82 Avenue |

Miami Warehouses Sold in 2nd Quarter 2016 (partial list):

| Buyer | Size SF | Property Address | Sale Price | $ PSF |

| Pasadena at the California | 216,312 | 600 NE 215 Street | $9,450,000 | $44 |

| COFE Properties | 167,200 | 7250 – 7280 NW 25 Street | $16,600,000 | $99 |

| GPT NW 32nd AVE | 123,125 | 11150 NW 32 Avenue | $8,150,000 | $66 |

| 16542 Holdings LLC | 92,889 | 16542 NW 54 Avenue | $4,820,000 | $52 |

| 2320 NW 147th Street LLC | 77,000 | 2320 NW 147 Street | $3,200,000 | $42 |

| Edgeconnex Miami | 68,165 | 475 NE 185 Street | $8,040,000 | $118 |

| AXL LLC | 60,000 | 7265 NW 74 Street | $3,500,000 | $58 |

| Terreno Realty | 53,558 | 1940-1970 NW 70 Avenue | $6,400,000 | $119 |

| Interglass Holding Co | 52,000 | 8150 NW 64 Street | $4,600,000 | $88 |

| Victoria’s Armoire | 45,899 | 5150 NW 37 Avenue | $2,780,000 | $61 |

| Alfoncito Investments Inc | 45,711 | 1090 NW 23 Street | $4,500,000 | $98 |

| Segura Holdings of Florida | 44,000 | 7500 NW 25 Street | $3,800,000 | $86 |

| 1800 Warehouse LLC | 37,500 | 1800 NW 96 Avenue | $1,580,000 | $42 |

| 67th Street | 31,720 | 3300 NW 67 Street | $2,210,000 | $70 |

| Bonamar Coporation | 26,000 | 12380 NW 116 Avenue | $3,750,000 | $144 |

Featured Property: 28,500 sq. ft. Warehouse Space in Doral for Sublease!

‘Class A’ warehouse for sublease located at 8190 NW 21st Street in Doral, Florida. This property is situated in a prime location within Miami International Commerce Center (MICC) and offers the following features:

‘Class A’ warehouse for sublease located at 8190 NW 21st Street in Doral, Florida. This property is situated in a prime location within Miami International Commerce Center (MICC) and offers the following features:

- 28,540 SQ. FT.

- 24’ CEILING HEIGHT

- 14 DOCKS & 1 RAMP

- ASKING $8.95 PER SQ. FT. GROSS

- SHORT TERM AVAILABLE; LEASE EXPIRES IN FEBRUARY 2018

- CORPORATE BUSINESS PARK SETTING

- INSTITUTIONALLY OWNED, WITH ON-SITE MANAGEMENT

Redlich Battles Against Sales Tax on Commercial Leases

As 2016 Chairman of the Commercial Alliance for Florida Realtors, Ed Redlich’s primary goal for the year will be to reduce or eliminate the sales tax on commercial lease agreements. “Our biggest goal is getting the state sales tax reduced on commercial leases. It’s not fair. A sales tax on property taxes is double taxation,” Mr. Redlich said.

CLICK HERE TO READ THE FULL ARTICLE FROM MIAMI TODAY >>>

“Did you know? Some warehouse buildings in the City of Doral are paying about $2.00 per sq. ft. in property taxes plus an additional $.14 cents per sq. ft. in Florida state sales tax on top of that. Example: a 10,000 sq. ft. building would pay $21,400 per year in property and sales taxes. This is exorbitant and double-taxation. Not fair!” – Ed Redlich

ComReal Miami Client Seeks to Purchase Industrial Land:

- Total Size: 5 to 10 Acres.

- Location: Miami-Dade County (North of Dolphin Expressway).

- Zoning: Industrial.

- Timing: 2016 – 2017.

- Purpose: Construction of a 100,000+ sq. ft. distribution warehouse.